Core Competencies and Selected Transactions

At TEAK, we specialize in driving operational transformation and creating value in complex environments. Our hands-on approach allows us to navigate challenging markets, execute strategic acquisitions and deliver sustainable solutions that ensure long-term business viability. From corporate acquisitions and restructurings to real estate transactions, we consistently achieve strong outcomes through meticulous analysis, determined execution and unwavering integrity.

Junior Flex is a leading provider of industrial and automotive solutions in Brazil. Formerly a subsidiary of Senior PLC, a UK-listed multinational, the company was acquired by TEAK in September 2019 amid imminent closure risks.

TEAK executed the acquisition on an expedited timeline to ensure business continuity and protect the jobs of the workforce. Following the rebranding to Junior Flex, a rapid turnaround plan was deployed—stabilizing operations, reinforcing key customer relationships, and setting the business on a path to sustainable growth.

The transformation quickly delivered strong operational and financial results, notably restoring profitability to both business units through improved product quality and on-time performance. Even during the turbulence of the COVID-19 pandemic, Junior Flex significantly expanded its market share.

This swift and hands-on intervention not only safeguarded the future of the business and its workforce but also preserved critical partnerships with suppliers and clients.

The Junior Flex case exemplifies TEAK’s capability to execute complex carve-outs from multinational corporations under tight timelines. It highlights our strength in preserving business continuity, protecting human capital, and accelerating value creation through decisive operational and strategic action—even in situations of acute distress.

Solina Brasil delivers a broad suite of industrial services, specializing in high- and ultra-high-pressure hydroblasting, vacuum cleaning, surface preparation, coating, and specialized manpower solutions. The company serves a blue-chip client base that includes Alunorte, Braskem, Brasfels, Vale, CSN, and Arcelor.

Following years of financial underperformance, Solina Brasil underwent a comprehensive restructuring under new leadership. The turnaround was driven by the renegotiation of key contracts with strategic clients, along with disciplined cost management and targeted operational enhancements.

Today, Solina Brasil is a highly profitable and resilient business, consistently generating value for both clients and stakeholders while maintaining a reputation for high-quality service delivery in demanding industrial environments.

Solina Brasil’s turnaround reflects TEAK’s expertise in corporate restructuring and hands-on management. By addressing fundamental cost and contractual matters, TEAK demonstrated its ability to restore financial health, rebuild client trust, and reposition companies for long-term stability and growth.

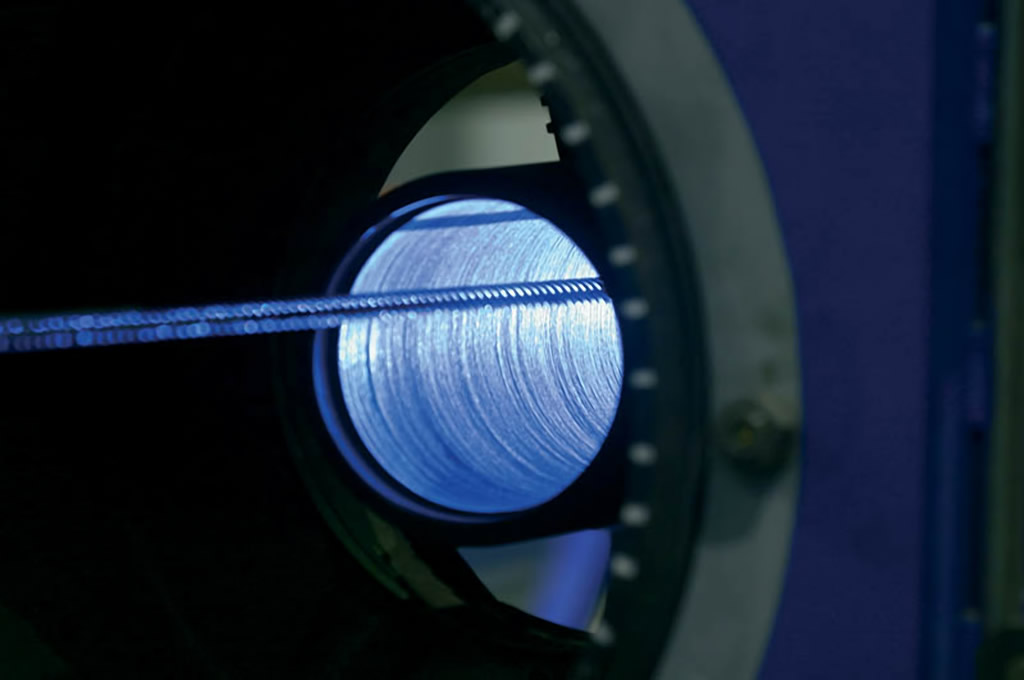

In 2013, TEAK was appointed by senior international lenders to lead the interim management of Canadoil Pipe Ltd. and Canadoil Asia Ltd.—integrated manufacturers of customized pipes, fittings, and advanced piping solutions serving global clients in the energy, resources, and water industries.

With Lampros Vassiliou stepping in as Canadoil’s CEO, TEAK orchestrated a strategic takeover plan in a contested scenario at the Amata City Industrial Estate in Thailand. The consolidation of manufacturing, coating, pre-fabrication, and fabrication activities into a single, centralized platform with leadership integrity, supported the buildup of a commercial pipeline valued at USD 900 million during the interim management period.

The Canadoil engagement underscores TEAK’s ability to drive rapid operational transformation and unlock substantial value in distressed, complex environments—especially where organizational, financial, and governance challenges intersect.

ConVeyBelts is a leading conveyor belt manufacturer in Brazil, originally established by Goodyear and later integrated into Germany’s Continental AG. In September 2016, following a rigorous assessment, CADE, Brazil’s antitrust authority, approved TEAK as buyer of the business.

At the time, ConVeyBelts faced serious operational and commercial challenges, including heavy dependence on a single client under an unfavorable contract. TEAK quickly executed a comprehensive transformation plan—diversifying the customer base by securing long-term contracts with blue-chip companies such as Vale, CSN, ArcelorMittal, and Anglo American. Concurrently, the company streamlined costs, improved labor relations, and strengthened its safety and environmental practices.

TEAK’s intervention not only preserved jobs and stabilized operations but also restored healthy competition in a highly concentrated market. Under TEAK’s ownership, ConVeyBelts reemerged as the quality leader in Brazil’s heavy belt segment, delivering substantial improvements in revenue and profitability. In 2020, TEAK completed a successful exit with the sale of 100% of the company to Michelin.

This case demonstrates TEAK’s ability to transform underperforming assets into market leaders and execute value-accretive exits to world-class strategic buyers. Our disciplined, hands-on approach ensures that businesses are not only stabilized but positioned for long-term growth—making them attractive to qualified acquirers.

Powerwave Technologies, formerly a NASDAQ-listed company, was a global leader in end-to-end wireless coverage and capacity solutions. Its portfolio included millions of antennas, repeaters, and base stations supplied to major telecom operators such as AT&T, Verizon, Sprint, T-Mobile, Vodafone, and other global carriers.

In 2013, amid Chapter 11 proceedings, TEAK acquired Powerwave’s sole global manufacturing facility through a Section 363 bankruptcy sale in the United States. Following the acquisition, TEAK restructured the operations, stabilized production, and preserved the asset’s core technical capabilities. In 2018, TEAK completed a successful exit with the sale of the facility to Korean technology company Innertron Inc.

The Powerwave acquisition highlights TEAK’s ability to identify and execute strategic transactions through U.S. bankruptcy courts. It demonstrates our capability to preserve and revitalize high-value industrial assets in distressed scenarios—leveraging speed, legal expertise, and operational focus to create value.

Founded in 1975 through a partnership between Ishikawajima Heavy Industries (now IHI Corporation) and Dai-Ichi High Frequency, Protubo gained international recognition as a pioneer in induction bending of metallic pipes for Brazil’s oil, gas, and infrastructure sectors.

In February 2015, TEAK acquired 100% of Protubo. However, following the Lava Jato crisis that resulted in the collapse of Brazil’s oil and gas industry, the company’s business model became unsustainable. TEAK responded swiftly, executing a structured and professional shutdown of operations.

A key step in the process was the full environmental decontamination of the company’s industrial site. TEAK then developed the sale of the land to MRV, one of Brazil’s leading publicly listed low-income housing developers. TEAK also sold industrial machinery to an industrial buyer. All creditors, including financial institutions, were paid in full, and employees received their legal entitlements in full. The original Japanese shareholders were fully shielded from any succession liabilities and reputational risks.

This transaction underscores TEAK’s ability to extract value from real estate and industrial machinery from distressed industrial assets. By managing environmental remediation, equipment repurposing, legal complexity, and stakeholder interests with precision and integrity, TEAK turned a business exit into a successful and impactful deal.